The following tables reveal general features that can be modified on a company by company basis. Some preferred stock issues may carry a provision entitling the shares for conversion to common stock. Suppose a business is liquidated, if the preferred shares are non-participating, then they simply receive their original investment (in this case 105,000) and any preferred share dividends outstanding. However, if salary differences for a cpa and non the stock is participating then in addition to the above, the stockholder would receive a share of the remaining proceeds of the liquidation. Many states require that stock have a designated par value (or in some cases “stated value”). In theory, original purchasers of stock are contingently liable to the company for the difference between the issue price and par value if the stock is issued at less than par.

- Please prepare a journal entry for dividends paid to preferred stockholders.

- The line items used for its reporting in the statement of cash flows are “issuance of common stock,” if the common shares are sold, and “issuance of preferred stock,” if the preferred shares are sold.

- Par value, though, often serves as the basis for specified dividend payments.

- On the other side, all bonds, including convertible ones, are essentially classified as liability item.

- If the annual dividend is listed as 4 percent, $4 per year ($100 par value × 4 percent) must be paid on preferred stock before any distribution is made on the common stock.

- This classification impacts the company’s leverage ratios and overall financial health, making it a crucial consideration for both management and investors.

Preferred Stock Dividends Journal Entry

Par value is the per share legal capital of the company that is usually printed on the face of the stock certificate. Company A issued 100,000 shares of preferred stock of $30 par value against $1,000,000 in cash and $2,000,000 worth of property, plant and equipment. In the early chapters of this textbook, “retained earnings” was defined as all income reported over the life of a business less all dividend distributions to the owners.

Accounting for Preferred Stock

Some shareholders may sell their stock between the date of declaration and the date of payment. To resolve this question, the board will also set a “date of record;” the dividend will be paid to whomever the owner of record is on the date of record. In the preceding illustration, the date of record might have been set as August 1, for example. To further confuse matters, there may be a slight lag of just a few days between the time a share exchange occurs and the company records are updated. As a result, the date of record is usually slightly preceded by an ex-dividend date.

Par value stock

While preferred stock mostly has a fixed percentage pay-off, in some cases it may have a component of payoff dependent on the profit of the company, such preferred stock is called participatory preferred stock. Another common feature of the participatory preferred stock is that it is entitled to participate in the liquidation proceeds of the company. For example, suppose a business issues 1,000 7% preferred equity stock with a par value of 100 at a premium issue price of 105. The company is required to pay the dividend to preferred shareholders which is different from the common shareholders. Recall that preferred dividends are expected to be paid before common dividends, and those dividends are usually a fixed amount (e.g., a percentage of the preferred’s par value). In addition, recall that cumulative preferred requires that unpaid dividends become “dividends in arrears.” Dividends in arrears must also be paid before any distributions to common can occur.

Please Sign in to set this content as a favorite.

Accordingly, the consolidated entity would not recognize in its income statement any gain or loss from the acquisition of the subsidiary’s preferred stock. Like other convertible securities, convertible preferred stock can be a helpful tool for small and newly formed businesses to make their initial fund raising efforts successful. It can potentially attract those investors who might otherwise not be enticed to put their investment in the company. The dividend will reduce the company’s retained earnings from the balance sheet. It is the deduction of the company’s accumulated profit and allocate to the shareholders. Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its shares.

Accounting for Preferred Stock: A Comprehensive Guide

For example, the preferred stock typically pays dividends at a fixed rate, and those dividends are paid before common stockholders. Preferred stockholders also have priority over common stockholders if the company is liquidated. The term “preferred stock” comes from the preference that is conveyed to these owners. They are being allowed to step in front of common stockholders when the specified rights are applied. Preferred stock where past, omitted dividends do not have to be paid before a dividend can be paid to common stockholders.

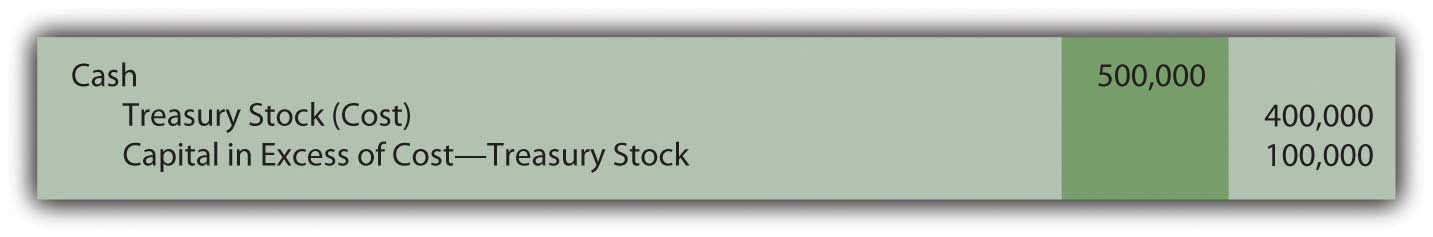

The convertible preferred stock was initially issued to stockholders at $65 per share. Corporations offer several types of preferred stock with different features and privileges, like cumulative, noncumulative, participating, convertible, and nonconvertible preferred shares. This article briefly explains what is convertible preferred stock and how the conversion of preferred shares to common shares is journalized in the books of issuing entity. Companies often establish two separate “capital in excess of par value” accounts—one for common stock and one for preferred stock.

It will decrease the amount of company retained earnings from the balance sheet. Many investors put a great deal of thought into where they want to put their money. With so many options available, it can be difficult to choose where to invest. However, one factor that often comes into play is whether or not a company pays dividends.

This guide aims to provide a comprehensive overview of the various aspects involved in this process. Learn the essentials of accounting for preferred stock, including types, measurement, dividends, and financial statement impacts. The amount at which the holder of preferred stock or bonds must sell the stock or bonds back to the issuing corporation. The call price might be the face or par amount plus one year’s interest or dividend.

In the event of liquidation, participating preferred shareholders may also receive a share of the remaining assets after all other claims have been settled. This type of stock is appealing to investors who want both stability and the potential for higher returns. Accounting for participating preferred stock involves not only tracking the fixed dividends but also calculating any additional dividends based on the company’s performance. Redeemable preferred stock can be bought back by the issuing company at a predetermined price after a certain date. This feature provides companies with flexibility in managing their capital structure and can be an attractive option for investors seeking a defined exit strategy.