A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Specifically, preferred stock with dividend payment included as part of the stock agreement can cause the stock to take on some characteristics of debt, since the company has to pay dividends in the future. For example, if a company takes on a lot of debt and then grows very quickly, its earnings could rise quickly as well. If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up. Using excel or another spreadsheet to calculate the D/E is relatively straightforward.

Importance of the Debt to Equity Ratio

- Generally speaking, short-term liabilities (e.g. accounts payable, wages, etc.) that would be paid within a year are considered less risky.

- All of our content is based on objective analysis, and the opinions are our own.

- While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.

- This usually happens when a company is losing money and is not generating enough cash flow to cover its debts.

- It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good.

The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow. The depository industry (banks and lenders) may have high debt-to-equity ratios. Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations.

Sales & Investments Calculators

One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor. It’s 25 must-know bookkeeping interview questions and answers for 2023 also helpful to analyze the trends of the company’s cash flow from year to year. Total liabilities are all of the debts the company owes to any outside entity. Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio.

How confident are you in your long term financial plan?

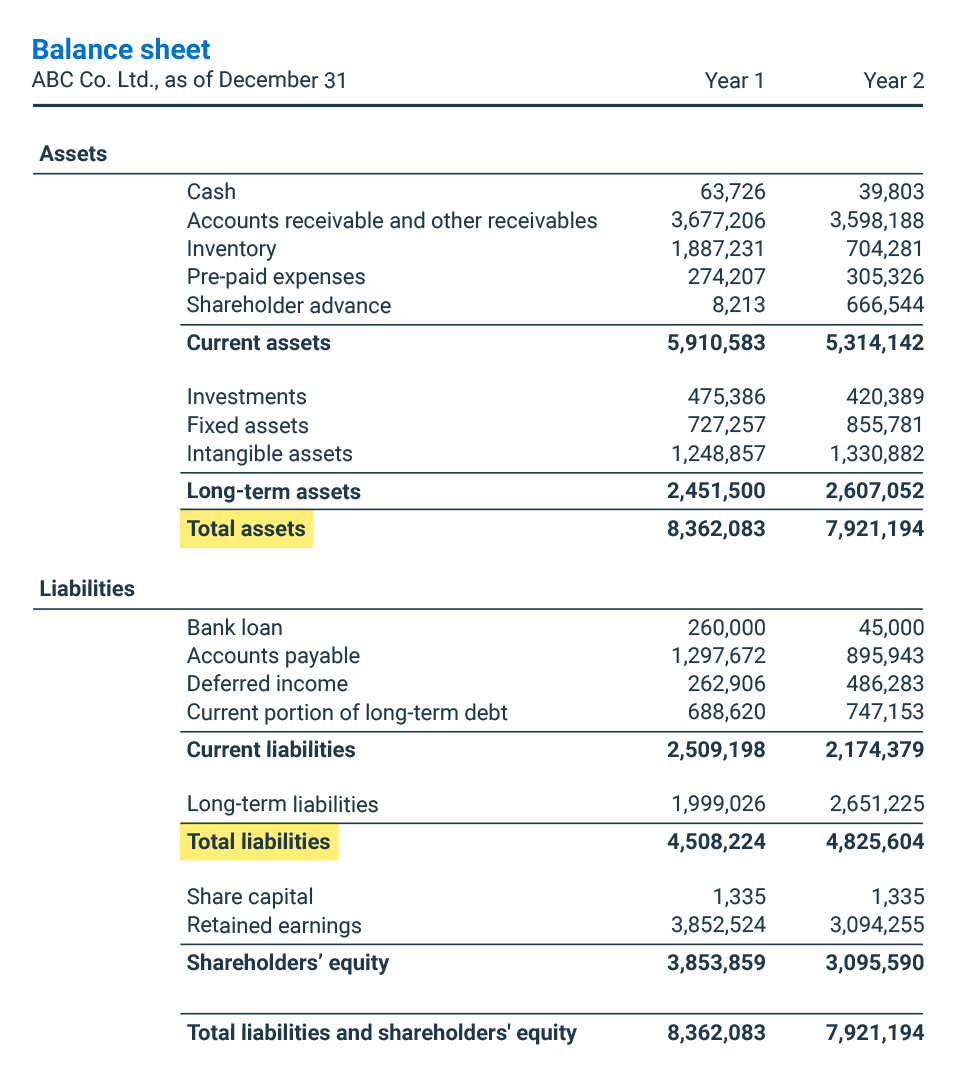

Let’s examine a hypothetical company’s balance sheet to illustrate this calculation. Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

Example D/E ratio calculation

When looking at a company’s balance sheet, it is important to consider the average D/E ratios for the given industry, as well as those of the company’s closest competitors, and that of the broader market. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule. All these ratios are complementary, and their use and interpretation should consider the context of the company and the industry it operates in. It is also worth noting that, some industries or sectors like utilities or regulated industries have a lower risk and thus have a lower debt-to-equity ratio.

There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector.

If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts. Also, this ratio looks specifically at how much of a company’s assets are financed with debt. When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet. Publicly traded companies will usually share their balance sheet along with their regular filings with the Securities and Exchange Commission (SEC).

This is because when a company takes out a loan, it only has to pay back the principal plus interest. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. In some cases, companies can manipulate assets and liabilities to produce debt-to-equity ratios that are more favorable. If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt.